Breaking News

November 5, 2021Bitcoin / Crypto / Latest NewsThe bitcoin (BTC-USD) price swooned on Thursday in London as investors digested the news that the US Federal Reserve plans to taper its $120bn (£88bn)-a-month in bond purchases.

This marked the first tentative steps towards winding down its post-COVID money-printing programme that had spurred on many crypto bets — with investors buying bitcoin as a hedge against inflation.

The Fed said it plans to reduce the pace of asset purchases by $15bn per month, starting in November. This will mean Treasury purchases will drop to $70bn from $80bn. Government-backed mortgage security purchases will also drop to $35bn per month from $40bn.

Bitcoin lost around 5% following the announcement.

The price of one bitcoin as of 10.30am GMT was $61,770, down 2.4% from the previous day of trade.

Bitcoin has, since its inception, been touted as a counterpoint to inflation.

Elsewhere in the market, ethereum (ETH-USD) came off all-time highs which saw it move past $4,600 to trade at around $4,500. The surge in price had come amid a bump in usage of its blockchain network.

Ethereum has also been hailed in recent weeks as a hedge against inflation due to the difference between the number of tokens issued and destroyed or “burned”. This turned negative in the last seven days on aggregate for the first time, according to blockchain tracking site watchtheburn.com.

Gains over the past week for the number two cryptocurrency are around 15%, thanks to optimism around its transition to Ethereum 2.0. [...]

November 5, 2021Bitcoin / Crypto / Latest NewsIt’s been a broadly bearish morning session for Bitcoin and the broader market.

At the time of writing, Bitcoin, BTC to USD, was down by 2.39% to $61,397.0.

A mixed start to the day saw Bitcoin rise to an early morning high $63,067.0 before hitting reverse.

Falling well short of the first major resistance level at $64,252, Bitcoin fell to a late morning low $61,277.0.

Steering clear of the first major support level at $60,862, however, Bitcoin revisited $61,900 levels before easing back.

The Rest of the Pack

It’s been a mixed morning for the rest of the majors.

Crypto.com Coin was up by 7.88% to lead the way.

Bitcoin Cash SV (+0.17%) and Polkadot (+0.55%) also found morning support.

It has been a bearish morning for the rest of the majors, however.

At the time of writing, Chainlink was down by 3.76% to lead the way down.

Binance Coin (-2.07%), Cardano’s ADA (-2.21%), Ethereum (-2.06%), Litecoin (-2.64%), and Ripple’s XRP (-1.90%) also struggled.

Through the early hours, the crypto total market cap rose to an early morning high $2,746bn before falling to a late morning low $2,690. At the time of writing, the total market cap stood at $2,688bn.

Bitcoin’s dominance rose to an early morning high 43.43% before falling to a low 43.10%. At the time of writing, Bitcoin’s dominance stood at 43.15%.

For the Afternoon Ahead

Bitcoin would need to move back through the $62,213 pivot to bring the first major resistance level at $64,252 and $65,000 levels into play.

Support from the broader market will be needed, however, for Bitcoin to break out from $63,500 levels.

Barring an extended crypto rally, the first major resistance at $64,252 would likely cap any upside.

In the event of another extended rally through the afternoon, Bitcoin could test resistance at $68,000 before any pullback. The second major resistance level sits at $65,603.

Failure to move back through the $62,213 pivot would bring the first major support level at $60,862 back into play.

Barring an extended sell-off through the afternoon, however, Bitcoin should steer clear of sub-$60,000 levels.

The second major support level sits at $58,823.

Looking beyond the support and resistance levels, we saw the 50 EMA narrow on the 100 and 200 EMAs this morning. We also saw the 100 EMA narrow on the 200 EMA.

Through the 2nd half of the day, a widening of the 50 EMA from the 100 and 200 would bring $68,000 levels into play.

Key through the late morning and early afternoon, however, would be to move back through to $63,500 levels. [...]

November 5, 2021Bitcoin / Crypto / Latest NewsWhile business and world leaders have struck new agreements on the energy transition at the COP26 climate summit in recent days, bitcoin (BTC-USD) has sustained a sky-high price above $61,000.

But concern over the energy-intensive process of bitcoin mining, which requires high-powered computers sometimes deployed on an industrial scale, has drawn scrutiny to the environmental impact of the world’s largest cryptocurrency.

In a new interview, Tom Steyer — a hedge fund billionaire and environmental advocate — described bitcoin as a “huge user of electricity,” contending the cryptocurrency will remain an environmental threat as long as the energy grid depends on fossil fuels.

Steyer sharply criticized bitcoin mining ventures that seek out cheap, dirty energy in order to maximize profits.

“Someone came up to me with a proposal — this is probably four months ago, so not that long ago — did I want to invest in a bitcoin mining operation next to a coal plant?” he says.

“The idea being you don’t have to transport the coal — it’s much cheaper we’ll be able to create bitcoin at a big spread to the current price. This is a great money making opportunity. That is a disaster. That is a straight up disaster,” he says.

Bitcoin mining, the process that records transactions and brings new bitcoins into circulation, demands miners solve complex math problems using advanced computation. In exchange, they receive a portion of bitcoin as a reward, making the task potentially lucrative, especially as the price of bitcoin continues to climb.

An analysis conducted by Cambridge University, released in February, found bitcoin mining consumes 121.36 terawatt hours a year of energy, which amounts to more than that consumed by Argentina, or more than the consumption of Google, Apple, Facebook, and Microsoft combined.

Influencers with Andy Serwer: Tom Steyer

In this episode of Influencers, Andy is joined by Galvanize Climate Solutions Co-Chair, Tom Steyer as they discuss sustainable investing and why the private sector must ‘step-up’ to solve climate change.

The global landscape of bitcoin mining shifted dramatically in May, when China banned the practice. Once the world’s top home for bitcoin miners, China ceded that role to the U.S., which as of last month hosted over 40% of bitcoin mining.

In the U.S., bitcoin remains largely unregulated. But top officials in the Biden administration have moved toward new rules for cryptocurrrency in recent months.

Treasury Secretary Janet Yellen has urged speedy adoption of rules for stablecoins, a form of cryptocurrency that pegs its value to a commodity or currency, like the U.S. dollar. Plus, SEC Chair Gary Gensler has described the crypto market as the “wild wild West” and indicated a desire to regulate it.

It remains unclear whether such regulations would affect cryptocurrency’s environmental impact.

“Bitcoin is a huge user of electricity,” Steyer says. “So to the extent that that electricity is derived from fossil fuels, and is emitting greenhouse gases and other dangerous toxins, then yeah, it’s a problem.”

Political activist Tom Steyer speaks during the “Need to Impeach” town hall event at the Clifton Cultural Arts Center, Friday, March 16, 2018, in Cincinnati. (AP Photo/John Minchillo)

Steyer rose to prominence as the founder and senior managing member of hedge fund Farallon Capital Management, which he departed in 2012. Since then, he launched the voter engagement organization NextGen America and became a leading advocate on environmental issues.

Speaking to Yahoo Finance, Steyer noted that the issue of bitcoin’s environmental impact ultimately comes down to the transition toward the sustainable generation of electricity.

“The real question is when you think about it: Clean up the electricity generation, electrify everything. Be smart about your energy use. That’s kind of the overall take on how we reduce emissions,” he says. [...]

November 5, 2021Bitcoin / Crypto / Latest NewsEthereum (ETH-USD) set a new record high for yet another consecutive day on Thursday, riding at least two macro themes entrenching themselves within the cryptocurrency sector.

The second-largest cryptocurrency traded above $4600 before paring those gains, but has logged record highs over the past week — thanks in part to the rising popularity of non-fungible tokens (NFT) and Decentralized Finance (DeFi) projects. Over the last year, ether has outperformed bitcoin, gaining more than 1025%.

Those factors have spurred short-term demand for paying transaction costs in the digital coin, plus growing speculation on its value for the so-called metaverse. The latter development is approaching warp speed, now that Facebook (FB) has rebranded itself in an aggressive push to lean into the next phase of digital’s development.

Solana (SOL1-USD), another cryptocurrency similar to ethereum, also leapt to new all-time highs Wednesday with an almost 31% gain in the last week. Both moves follow an investment frenzy for NFTs or non-fungible tokens.https://flo.uri.sh/visualisation/6190406/embed?auto=1

Ether’s blockchain: The gas that propels crypto transactions

Up 9% this week alone, ETH might have further to go in the near term, according to Fundstrat Global Investment Advisors.

“Ethereum should still rally higher up to $4,951 with little to no resistance,’ wrote Fundstrat Global Investment Advisors on Wednesday. Ether’s Relative Strength Index (RSI), the technical gauge of buying momentum, shows the price has managed to churn higher without becoming noticeably overbought.

Everyone’s hearing about Ethereum in ways that have never happened before because of NFT’s. People get excited by NFTs,”David Hoffman, ‘Bankless’ podcast host

Ether’s underlying blockchain, Ethereum, is the world’s most established decentralized blockchain protocol (or “Layer-1” in technical terms) for smart contracts in the world.

While it doesn’t receive the same investor demand as Bitcoin (BTC-USD), ether often serves as the “next stop on the trip down the digital asset rabbit hole” according to Chris Matta, President of digital asset manager, 3iQ Digital. His firm has offered both a Canada-based spot Bitcoin exchange-traded fund (ETF) as well as the ether equivalent for several years.

Unlike Bitcoin, which is mainly used as a store of value, the price surge in Ether comes due to growing demand for people to use its blockchain to transact. Like fuel in a car, ether acts as the gas that propels transactions across its payments network.

The cost of transactions (or gas fee) varies based on the size of a transaction, and how congested the network remains at any given time.

The majority of DeFi protocols and NFTs reside on top of the Ethereum blockchain. Together, these two budding digital asset segments have created surging demand for transactions or “blockspace space” on Ethereum.

As of November, there’s $219 billion in total value locked (TVL) within decentralized finance or DeFi. During the same time frame, trading from NFTs amounted to $4.2 billion according to DappRadar.

“The demand for block space has continued to go up, and the transaction throughput has not been able to increase with that demand. You’re seeing gas prices increase drastically as people fight for block space. That results in actual rising demand for Ether,” Matta told Yahoo Finance.

While great in the short-term, this surging demand for ether also poses a long term problem for the asset.

“Ethereum is struggling a bit right now under the amount of its network activity. Gas fees can vary drastically and there’s competition now with other blockchains that offer lower transaction costs,” said Gatta.

The standard gas fee on various DeFi protocols vary widely but crypto exchange Crypto.com currently prices average transactions between $111 and $170 per transaction.

Hands holding a tablet computer are pictured during a tour through the urban NFT LAB called “GAME OVER” by the artist group Die Dixons (aka XI DE SIGN) in Berlin, Germany, October 6, 2021. REUTERS/Annegret Hilse

Ethereum is ‘metaverse money’

Ethereum’s price also stems from the latest wave of investor interest in NFTs, which has begun to catch the attention of both major U.S. consumer brands and pop-culture icons.

“Everyone’s hearing about Ethereum in ways that have never happened before because of NFT’s. People get excited by NFTs,” David Hoffman, an Ethereum bull and co-host of the crypto-focused podcast Bankless, told Yahoo Finance.

One of the hotter frontiers within the crypto sector, NFTs are serving as crypto-secured certificates of authenticity for a variety of digital goods from ine art and music albums to collectibles and video game assets.

Recently, big brands have hopped into the market. This week, fast food giant, Mcdonald’s (MCD) created a sweepstakes to give away NFTs of their McRib sandwich while Nike (NKE) filed for a patent, signaling plans to launch digital versions of their sneakers and clothing as NFTs.

For these brands NFTs act like “digital merchandise,” Hoffman explained, with most of them still being created on top of Ethereum as the blockchain’s ERC-721 form of token.

And the frenzy has only accelerated this month thanks to Facebook’s official rebranding to Meta, which positions the company to propel investments into building the “metaverse,” a more immersive version of the internet.

NFTs will play a central role within the metaverse, both Hoffman and Gatta said. That means, ETH and other cryptocurrencies propelling smart contract-based blockchains like Solana act as the underlying base layer for investor speculation on the metaverse.

“Ethereum is metaverse infrastructure and ETH is metaverse money,” Hoffman added. [...]

November 5, 2021Bitcoin / Crypto / Latest NewsSenator Pat Toomey, ranking member of the Senate Banking Committee, says he’s not on board with the Biden administration’s proposal to regulate stablecoin issuers as banks, as Capitol Hill moves to adapt existing securities law to accommodate the booming cryptocurrency sector.

The President’s Working Group on Financial Markets earlier this week recommended that Congress come up with a new framework to regulate stablecoins, urging lawmakers to mandate that only banks can issue stable coins.

When asked by Yahoo Finance whether he supports the administration’s proposals, the Pennsylvania Republican acknowledged one of the proposal’s central arguments: that Congress needs to act.

However, his remarks presaged what is likely to be a spirited debate about cryptocurrency regulation, highlighting how lawmakers have found little consensus on how to proceed.

“It is not at all obvious to me that the optimal outcome is to treat all stablecoin issuers as though they’re banks, or force them to become banks,” Toomey said in an exclusive interview.

The senator added: “I can see an argument for that, but I can see arguments for treating stablecoin issuers very differently as well…Congress ought to have this debate.”

The administration’s recommendations are intended to curtail risks regulators’ worry stablecoins – digital currencies with values tied to fiat currencies like the U.S. dollar or short-term securities — pose to the financial system.

Stablecoins are used by traders to get in and out of trades, settle trades and are increasingly being used for lending, or borrowing of other digital assets on cryptocurrency exchanges. Regulators worry that if the value of cryptocurrencies plunge suddenly, investors could yank their money out, leading to a run on stablecoins that could hurt the financial system and users.

Officials are also trying to set rules to ensure that adequate liquidity will exist for stablecoin use, if it is widespread in the payment system. Additionally, like ordinary FDIC-insured bank deposits, users should be able to get their stablecoins back on demand.

While Toomey doesn’t think stablecoins should be regulated as banks, he says he hasn’t come to a final conclusion on how the tokens should be policed. He did say there should be transparency and disclosure about the assets that back a stablecoin.

“Beyond that, I think we have to really think long and hard before we put some onerous regulatory regime on a new technology,” Toomey told Yahoo Finance.

He argued that one of the dangers is that the recommendations could give big banks an unfair advantage at the expense of startups.

“When I read through the report, it does kind of have the feel of a report issued by bankers, or by people who have a very bank-centric mindset, and I think we should not automatically go down that road,” he added.

Toomey also expressed doubt that the Financial Stability Oversight Council (FSOC) should be tasked with designating stablecoin activities as systemically risky.

“It’s a big mistake to suggest that in the absence of imminent Congressional action, the FSOC should designate this activity that takes us down the wrong road,” she added.

The new rules, if implemented, could freeze out Facebook (newly christened as Meta) from issuing its stablecoin Diem.

The proposals underscore that while banks should be the only entities issuing stablecoins, corporations shouldn’t intertwine their business with stablecoin issuers either. Toomey says that’s an important question raised by the report.

“It’s not obvious to me that we are ready to come to that conclusion. I can see, think of arguments both for and against a large non-banking entity issuing a stablecoin,” he added. [...]

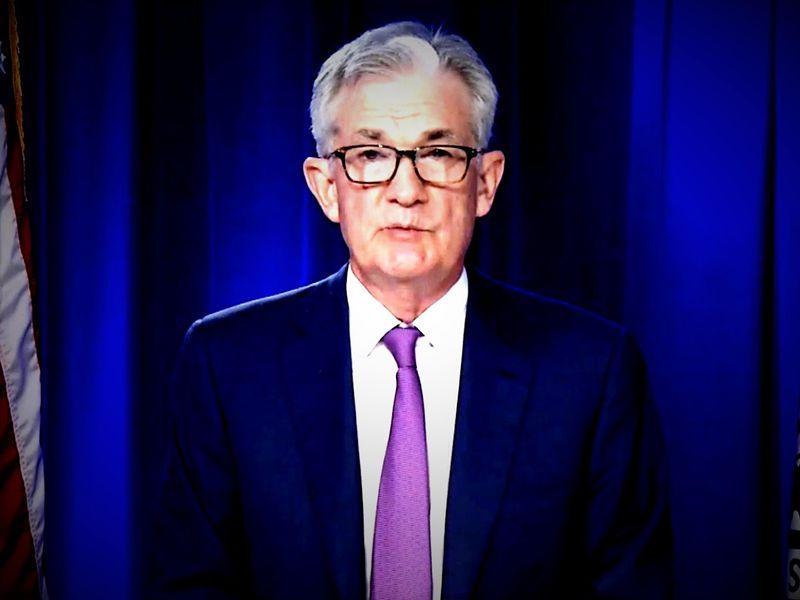

November 5, 2021Bitcoin / Crypto / Latest NewsThe U.S. Federal Reserve announced plans to taper its $120-billion-a-month in bond purchases, taking the first step toward winding down a post-coronavirus money-printing program that has inspired many investors to buy bitcoin as a hedge against inflation.

The Fed said Wednesday in a statement that it will reduce the pace of asset purchases by $15 billion a month starting this month. Purchases of U.S. Treasurys will drop to $70 billion a month from $80 billion, while purchases of government-backed mortgage securities will decline to $35 billion a month from $40 billion.

Under the plan, the Fed will continue to wind down its purchases by $15 billion every month until the program concludes during the middle of next year.

“The committee judges that similar reductions in the pace of net asset purchases will likely be appropriate each month, but it is prepared to adjust the pace of purchases if warranted by changes in the economic outlook,” the Fed’s monetary policy committee, known as the Federal Open Market Committee, or FOMC, said in the statement.

The asset purchases – a form of stimulus funded by newly created money, known as “quantitative easing,” or QE – have helped to more than double the size of the Fed’s balance sheet since March 2020, to about $8.6 trillion as of last week.

Bitcoin price

The U.S. central bank left interest rates unchanged at close to 0%, but a growing number of analysts in traditional markets are predicting the Fed might have to start hiking the benchmark rate to tamp down inflation at a time when U.S. consumer prices are rising at a clip not seen on a sustained basis in three decades.

So If the Fed stays the course and tilts hawkish on inflation, bitcoin might look incrementally less attractive as a hedge against dollar debasement, and the cryptocurrency’s price could come under downward pressure similar to the predictions for the stock market.

Bitcoin’s price briefly dropped after the statement but by press time was essentially unchanged around $62,300. The Fed’s decision had been fully telegraphed by officials prior to the meeting, and thus may have been anticipated by the market.

“On one hand, tightened monetary policy may lead to less rapid growth of bitcoin demand, as many use it to hedge inflation, and less QE in theory means less inflation,” said Joe DiPasquale, CEO of the cryptocurrency hedge fund BitBull Capital. “On the other hand, the effects of the largest QE in history may lead to the largest inflation in history, regardless of the Fed attempting to scale back. If this happens, we expect demand, and prices, for bitcoin to rise to new all-time highs.“

DiPasquale said that BitBull has a price target of $80,000 for bitcoin by the end of 2021.

‘Expected to be transitory’

Fed Chairman Jerome Powell had signaled during a meeting in September that there was “broad support” to begin tapering of the asset purchases, based on a plan to complete the effort “sometime around the middle of next year, which seems appropriate.”

A growing group of high-profile investors including the legendary hedge fund manager Paul Tudor Jones II and the venture capitalist Peter Thiel have joined many crypto traders in betting that bitcoin can be effective as a hedge against inflation. That’s mainly due to the limits on new supplies of bitcoin, as hard-coded into the 12-year-old blockchain’s underlying programming.

JPMorgan analysts wrote recently that more investors are seeing the cryptocurrency as an inflation hedge.

But bitcoin also has often been highly correlated with U.S. stocks, which can come under downward pressure when the Fed tightens monetary policy, because higher borrowing costs often translate to higher financing costs for companies, potentially becoming a drag on quarterly profits.

In Wednesday’s statement, the FOMC said it noted that inflation was “elevated” but said the factors behind the consumer price increases were “expected to be transitory.” [...]

November 5, 2021Bitcoin / Crypto / Latest NewsAmerican podcast host Joe Rogan has agreed to be paid $100,000 in Bitcoin.

Rogan has already signed a $100 million deal with Spotify for exclusive rights to his podcast, but has now negotiated to be part-paid in crypto as well.

Rogan has been known as a crypto advocate since he urged his audience of 200 million to buy Bitcoin and ‘start stacking Sats’.

On his podcast – the Joe Rogan Experience – Rogan, also a good friend of Twitter’s CEO Jack Dorsey, promoted Bitcoin as part of an app advertisement and praised its ability to let users automatically purchase Bitcoin at different intervals based on their preferences.

“With the Cash App, you can automatically purchase Bitcoin, daily, weekly, or even bi-weekly, known in the industry as stacking sats,” he said.

“Bitcoin, what it is for sure, is a transformational digital currency that acts as a decentralized peer-to peer-payment network powered by its users with no central authority.

“I love it. I wish it was the way we exchanged currency and maybe it will be in the future. Get on board.”

NFTs are crypto hustle

However, even though he likes crypto, he seems perplexed when it comes to non-fungible tokens (NFTs).

Recently, Rogan called NFTs a “cryptocurrency hustle” and added he was not interested in NFTs.

“NFTs are weird hustle, I think it’s like a cryptocurrency hustle. It doesn’t make any sense to me,” he commented. [...]

November 5, 2021Bitcoin / Crypto / Latest NewsBanks should focus on blockchain technology and investors should increase their bitcoin holdings while trimming gold exposure, according to Jefferies Global Head of Equity Strategy Christopher Wood.

“This concept of how has begun to eat conventional finance is why all banks should be focused on the technology to see how to try and profit from it rather than to wait and be disrupted by it,” Wood said in a note on Thursday.The analyst also noted that if blockchain technology disrupts the conventional finance sector by eliminating the need for intermediaries, it can also potentially trigger the end of the “dollar paper standard.”Wood said he will be adding another 5% to his bitcoin exposure, bringing it to 10%, while cutting 5% exposure to gold in his global, long-only asset allocation portfolio recommendation for his U.S.-dollar-based pension funds.His portfolio recommendation currently has 40% gold, 30% Asia (excludingJapan) equities, 20% unhedged gold mining stocks and 10% bitcoin exposure.Wood is not putting ethereum in the fund portfolio, however, because he doesn’t think it is a “store of value” asset. However, he expects the second-largest cryptocurrency by market value to outperform bitcoin in the coming months. [...]

November 5, 2021Bitcoin / Crypto / Latest NewsFollowing a volatile September, the crypto market rebounded to an all-time high in October, with DeFi’s TVL exceeding $250 billion and BTC pushing past $66K.

crypto market tvl chart

DeFi TVL Change

Data source: Footprint Analytics

But with all eyes on rising token prices, it was easy to miss some trends and announcements that look likely to impact the market in Q4 significantly.

DeFi will be getting more regulated as countries announce sweeping cryptocurrency policiesBitcoin ETFs attract global attention, creating positive outlook as institutional investors buy inLending market lacks clear leader as Curve and MakerDAO vie for top spotNumerous new public chains see big growth shortly after launching

Read how these developments and others will affect the crypto market in Footprint’s October Monthly Report.

Bitcoin futures ETF triggers new high for BTC

With Grayscale announcing a series of plans to convert Bitcoin funds into spot ETFs and digital asset investment firm Valkyrie listing its bitcoin futures ETF on NASDAQ, the price of BTC climbed from $48,000 to around $60,000. On Oct.20, BTC even reached a record high of $66,000.

Investors now have very strong support for the thesis that institutions will gradually purchase crypto assets. This means we can imagine a world where banks make massive whale purchases of BTC and other tokens.

BTC and ETH Price change crypto market

BTC and ETH Price Change

Data source: Footprint Analytics

Two aspects bolsters the DeFi TVL’s growth in October :

Lending market sees competition among dominant platforms

The TVL ranking from Footprint Data shows that Aave and MakerDAO once surpassed Curve in the middle of the month to become the projects with the highest DeFi TVL, but quickly fell back behind.

As of October 31, Curve was still ranked number one on the network with $19.2 billion TVL. Curve’s TVL grew by 34% for the month of October and its token price reached $4.7, the highest in almost a year. MakerDAO also had a 37.68% TVL growth rate.

The data indicates that the lending market is highly competitive – with picking a favourite for market leader nigh impossible. In other words, now is not the time to put all your eggs in one basket in your DeFi lending play.

Protocol TVL Ranking crypto market

Protocol TVL Ranking(2021/10/31)

Data source: Footprint Analytics

Curve Token CRV Price and Volume Trends crypto market

Curve Token CRV Price and Volume Trends

Data source: Footprint Analytics

Chains eat away at Ethereum’s monopoly

Since its inception, Ethereum held a near monopoly in the public chain space until Binance came onto the scene in February 2021, followed by Terra and Polygon.

Data from the past month indicates a clear trend towards further fragmentation rather than consolidation.

Footprint Data shows there are 11 public chains with a TVL growth of more than 100% in the past 30 days. Among them, Tron’s growth rate was 1119%, bridging its TVL to $7.6 billion, making it the seventh chain. Other public chains such as Fantom, Arbitrum and Avalanche grew by more than 100%.

The result is that Ethereum’s market share went from 73% in August to 65% in October—and 8% drop in just 2 months.

Change of Market Share by Public Chain crypto market

Change of Market Share by Public Chain

Data source: Footprint Analytics

New kids on the crypto block in October

Newly-launched chains beat expectations in October.

The TVL of Secret grew 222% as tightening regulations around public chains make blockchain users refocus on privacy. PriFi – as it’s now called – will soon become the preferred choice for crypto, and Secret, the first Chain with privacy protection, will explode (at least, so goes the reasoning of the chain’s supporters).

Another chain that shouldn’t be ignored is NEAR. While its 86% growth is slow compared to the month’s other breakouts, the chain’s team recently announced a huge $800 million ecosystem development fund to support NEAR-based development projects, institutions and individuals. Aurora, a NEAR-based solution to scale Ethereum dApp projects, also completed a $12 million funding round in October.

Other public chains such as Sifchain, Harmony, and Celo each had in excess of 200% growth in October and are also noteworthy. Although the new public chains are still nowhere near as popular as the Etherchain, market share continues to divide as they present new use cases and solve problems developers and users face with Ethereum.

TVL Growth Rate of Top5 Public Chains crypto market

TVL Growth Rate of Top5 Public Chains

Data source: Footprint Analytics

Summary

With the introduction of national policies around crypto in the US, China, Australia and others in September, the market briefly became volatile, but a record-breaking October demonstrated we’re still riding the bull for now.

On a more long-term trajectory, the token price drop and regulations were followed by institutional support and buy-in for blockchain. While controversial amongst blockchain enthusiasts, this has created a perception of reduced market risk among established financial players. Is this the news that banks and investment firms, tired of seeing their returns blown out of the water by crypto traders, were waiting on as their signal to jump in?

October Key Events Review:

Policy and News:

Fed Chairman: The Fed has no plans to ban cryptocurrencies.S Justice Department to set up a cryptocurrency enforcement team.China National Development and Reform Commission.” Virtual currency ‘mining’ activities” will be included in the phase-out of production industries.Valkyrie Bitcoin Futures ETF first-day trading volume was US$78 million, the second-highest first-day trading volume ever.Grayscale plans to apply to Convert Bitcoin Funds to Spot ETFs.Facebook changed the company name to Meta.Facebook plans to hire 10,000 people in Europe to build a Meta-UniverseCoinbase called on U.S. to pass new legislation and create new regulator to oversee cryptocurrencies

Public Chain:

Fantom surpasses a record high of 1 million unique addresses on the chain.NFT public chain Unique Network raises $11.3 million.NEAR launches $800M eco-development fund to focus on the DeFi space.Polygon has about 3,000 DApps on it, 62% of which are deployed on Polygon only.

NFT:

Coinbase to Launch NFT marketplace by Year-End.Sotheby’s and Future Perfect Ventures invest $20 million in NFT technology company Mojito.NFT studio Candy Digital closes $100 million Series A funding round, valued at $1.5 billion.OpenSea website traffic has reached the top 500 worldwide.CryptoPunks’ derivative NFT project PUNKS Comics surpassed $500 million in total trading volume.

DeFi:

SHIB market cap overtakes Polkadot and ranks 8th in cryptocurrency.Ether destroyed over 700,000 pieces with a total value close to $3 billion.Ethernet DeFi protocol Cream Finance suffered an attack and lost $115 million.Ethereum market cap ranking rose to the 15th place among global assets, overtaking Alibaba.Uniswap’s total transaction volume exceeds $500 billion.

What is Footprint…

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint. [...]

November 5, 2021Bitcoin / Crypto / Latest NewsHow much do you know about cryptocurrency? If the answer is, “Not a lot,” you’re not alone.

A recent survey of 1,000 people across the U.S., Mexico and Brazil showed that 98% of people don’t understand basic crypto concepts. For instance, 90% didn’t know that the Bitcoin supply is capped at 21 million. Equal numbers didn’t understand stablecoins, either.

What’s worse, 98% of people scored less than 60% (under 65 is traditionally considered a failing grade in school) on a 17-question quiz about crypto, The Crypto Literacy Survey. Administered by YouGov, the survey was part of a report by CryptoLiteracy.org, an initiative led by Coinme, CoinDesk, and Digital Currency Group, Blockworks reported.

The survey highlighted the need for crypto education, as bitcoin has emerged as a recognized asset class and is growing in prevalence. Coinme is the first state-licensed bitcoin ATM company in the U.S. The company also expanded to include digital wallet and private client services. “Now that we have the largest licensed on-ramp in the U.S., we can really double down on efforts to help educate the broad population in order to understand how to utilize digital currency,” said Coinme CEO and co-founder Neil Bergquist in an article published by Blockworks.

Bergquist pointed out that he was most surprised that people didn’t understand Bitcoin has a fixed supply of 21 million, noting that it is one of its “greatest value propositions.” Twenty-one percent of Americans thought Bitcoin supply was “infinite,” while 62% couldn’t even take a guess at the maximum supply. Additionally, only 40% of people understood what determines Bitcoin’s price at any given moment.

While 30% of Brazilians and 28% of Mexicans said they intend to purchase or sell crypto in the next six months, only 12% of Americans said the same. However, 17% of Americans surveyed already own crypto, versus 15% of Brazilians and 14% of Mexicans. Two-thirds of respondents across the three countries said they do not believe it’s easy to purchase cryptocurrency.

“I agree that people have a long way to go on educating themselves about crypto, but the good news is they are working hard to get there,” Matthew Hougan, chief investment officer of Bitwise Asset Management, told Blockworks. “I suspect these statistics will change rapidly over the coming months and years.” [...]

November 11, 2021CryptoExchange is one of the most common words you hear in today’s crypto space. And rightfully so. You can buy and sell cryptocurrency on an exchange. But that’s where the problem lies.

Exchanges are centralized, which means they control your money. If you want to trade or withdraw funds from an exchange, you must go through a KYC process and sometimes, wait days for a transaction to clear. That’s where a DEX (decentralized exchange) comes into play.

A DEX is where you can trade crypto without third parties. But there are plenty of DEXs out there claiming they’re “decentralized,” but sometimes these platforms don’t live up to the name.

So your crypto becomes the target of hackers, the lunch of exit-scammers, or the escape money of bankrupt exchanges on the brink of ruin!

It was recently announced that the Peerplays’ DEX is coming to the Hive blockchain platform along with many other features. In this blog, the Peerplays team explores the Peerplays’ DEX and discusses the features that make it one-of-a-kind, compared to others available today.

The Problems of Centralized Exchanges

Order visibility and statuses are essential. They help prevent scenarios where a non-decentralized exchange blocks orders from execution, leading to missed opportunities in the crypto market, or worse, catastrophic losses. You may have come across some news that people complained about orders failing to go through when it mattered most.

Centralized exchanges come with a high risk of colluding with outsiders and manipulating end-user funds. With every centralized exchange such as Binance or Coinbase, you run this same risk where your operations can be at stake because they are so centralized in nature.

This is worrying because centralized exchanges are the most popular way for traders to trade. Unfortunately, those exchanges come at a cost in security- where accounts are frozen or even hacked!

DEX Challenges

Right now there are several challenges standing in the way of decentralized exchanges (DEXs) taking off.

For one thing, liquidity is low due to the few trades happening on these platforms; this makes it difficult, if not impossible at times, to trade! Though there have been improvements thanks to an increase in liquidity pools, there must be a better way…

Introduction to Peerplays’ DEX

Peerplays is an open-source blockchain that provides the fastest, most decentralized blockchain consensus model available today. Built with Graphene technology and Gamified Proof of Stake (GPoS), Peerplays brings a new paradigm of fairness, trust, speed, and security.

Your assets are always right in front of you. You can see what’s been bought or sold, manage open orders and check out settings for your profile effortlessly. With Peerplays DEX, everything is transparent and visible. The platform’s built-in wallet allows you to keep your assets and trade them whenever you like while maintaining full ownership of private keys–no third party involved!

You can deposit your Bitcoin and HIVE into the DEX with a few easy steps. We are committed to adding more popular assets in future updates so that you can enjoy them on this decentralized exchange too. When these assets are on the Peerplays chain, they benefit from short 3 second blocks.

They can be traded or swapped like any other Peerplay asset and withdrawn back into their original chains if need be! When this off-chain data moves onto our network, it is always backed up by equal amounts on its original chain. Assets that you own can be sent to any other Peerplays account. When on the Peerplay chain, Bitcoin and HIVE are easily transferable between each other or even back onto their original chains.

The Peerplays DEX is the perfect place for people who care about decentralized capabilities, access to features like NFTs, and upcoming DeFi protocols. In addition, it has native Bitcoin support (with fast transactions and low fees). The interface will be under continuous refinement to ensure it’s easy to use. The Peerplays’ DEX is different from other DEXs because it supports cross-chain swaps using decentralized support for chains like Bitcoin, Hive, and will continually add popular crypto in the near future), plus, DeFi. (Essentially SONs and DeFi)

HIVE will be leveraging Peerplays’ DEX to bring the HIVE community an enriched experience.

Why use the Peerplays’ DEX

Decentralized gateways & payments

Peerplays DEX has decentralized gateways. This becomes essential for any tokens created on the Peerplays network.

Built-in DEX Support for Peerplays-created Tokens

The DEX has built-in support that can pair tokens created by Peerplays with Bitcoin and other IOU (I owe u) tokens. This brings down cost and time tremendously when you need to transfer or trade crypto.

Extensive interoperability

One of the many unique characteristics of Peerplays is its Sidechain Operating Nodes (SONs), which translates to interoperability and greater convenience.

In addition, fully decentralized Bitcoin support via SONs will be coming soon.

Proven built-in order book

Peerplays’ DEX and trading will happen using a built-in order book that has already been battle-tested with Bitshares.

Ease of token creation and tokenomics support

Peerplays is working on providing a DEX-UI (user interface) for people to create tokens and decide on the tokenomics (like max number of tokens, fee pool, pegged assets, etc).

Thus, the DEX-UI will have all the features to easily create tokens, decide on tokenomics and distribute tokens following innovative methods.

Features of the Peerplays’ DEX

The Peerplays DEX is much more than a cryptocurrency exchange, with the DEX, you can.:

✔️ use the DEX as a wallet to manage assets in addition to trading assets

✔️ take advantage of Peerplays’ liquidity pools and swap assets (Liquidity Pools via upcoming DeFi support)

✔️ participate in blockchain governance by casting votes

✔️ maintain control over your Peerplays account

✔️ send and receive BTC or HIVE from your own account

✔️ stake your assets and earn rewards and voting power via GPoS

✔️ convert stakes assets into NFTs and enjoy modest rewards (or even sell the aged NFT)

✔️ instantly swap your assets using an automated market-making algorithm (in progress)

✔️ cast your votes on important blockchain issues and the direction of the project on the DEX.

✔️ vote for Node Operators who will run the network in a way you want them to

✔️ set your prices (through the market, limit, and stop-limit orders)

✔️ trade at any moment without moving assets (the wallet is built into the DEX)

✔️never worry about hacked exchanges, exchanges going bankrupt, exit scams, or government intervention (for now)

A rare-breed of DEXs

Peerplays is a DEX that’s built with you, the end-user, in mind. We’re committed to building an ecosystem where users have impeccable convenience and zero worries about third parties being involved. Everything about Peerplays is open-source, so there aren’t any hidden strings attached.

Your trust should be the center of everything. That’s why the DEX will end up being 100% decentralized as well as scalable by design. So it’ll always be running on solid ground without compromising user experience or security. There are ultra-fast BTC transactions, availability of on-chain NFTs and DeFi protocols. All in a fair platform that makes you feel confident.

You can learn more about Peerplays DEX here.

The post Next-generation DEX: A look at the many features the Peerplays DEX offers appeared first on CryptoNinjas. [...]

November 11, 2021CryptoBitcoin Suisse, a Switzerland-based crypto-financial services company, is today announced the availability of Bitcoin Lightning technology for its crypto payment solution.

The introduction of the second-layer Bitcoin solution will offer instant transactions at lower blockchain fees for consumers as well as merchants working with Bitcoin Suisse and its partner Worldline.

Lightning is a decentralized network based on Bitcoin’s second layer that uses smart contracts to create a secure network – allowing small value transactions at high speeds, eliminating high blockchain fees.

From today, merchants working with Bitcoin Suisse and Worldline, a European-based payments and transactional services company – will be able to accept transactions made via the Lightning Network.

Users will see the following benefits in the application and acceptance of Lightning-based transactions:

Lightning-fast transactions measured in milliseconds with instant settlement

Scalability and increased capacity thanks to the speed of the network

Competitive blockchain fees independent of network utilization

“Secondary layer solutions like Lightning add important use cases to on-chain transactions and are crucial to scaling blockchain solutions. We will look into adding lightning support to additional services we provide at Bitcoin Suisse.”

– Niklas Nikolajsen, Founder and Chairman of Bitcoin Suisse

The post Crypto services platform Bitcoin Suisse integrates Bitcoin Lightning technology appeared first on CryptoNinjas. [...]

November 11, 2021CryptoUbitquity, an enterprise blockchain-secured platform for real estate and title recordkeeping, today announced that it has partnered with Palm Beach-based HeightZero Real Estate & Consulting, LLC.

HeightZero Real Estate & Consulting is located in South Florida and specializes in AI & Blockchain solutions in real estate and development, including handling real estate transactions with cryptocurrency.

This new partnership can bring many potential customers to Ubitquity’s SmartEscrow platform ecosystem which includes title, escrow, and banking partners. SmartEscrow will help make this a more seamless experience for HeightZero Real Estate & Consulting and their customers.

We are pleased to be working with a renowned real estate company that understands our SmartEscrow technology, and the groundbreaking implementation of stable coins. Laura Pamatian, Founder of HeightZero Real Estate & Consulting, is leading the way as a resource to real estate developers, commercial and residential property owners as they consider tokenization options for sales transactions, alternative capital raise and liquidating equity.”

– Nathan Wosnack, Founder & CEO of Ubitquity

With a number of Blockchain as a Service (BaaS) tools available on its unanimity platform, Ubitquity has successfully integrated across a variety of industries including real estate for escrow and title closing support, title abstracting, smart contract management, as well as secure document management.

Moreover, Ubitquity can help with regulatory-compliant token sales, integration consulting, real estate NFT (Non-Fungible Token) creation, and more.

The post Ubitquity partners with HeightZero to bring blockchain escrow to Florida real estate appeared first on CryptoNinjas. [...]

November 11, 2021CryptoDeribit, a cryptocurrency derivatives exchange based in Panama, announced today its been integrated into CryptoStruct, which now offers low-latency market data and order entry gateways to Deribit.

Through using CryptoStruct’s high-performance strategy framework, clients can now easily scale their trading activity onto another exchange and thereby benefit from higher revenue potentials.

“By including Deribit to our global exchange coverage, clients can now trade on 10+ exchanges via CryptoStruct’s high-performance product, and we very much appreciate Deribit’s support during the development and connectivity phase.”

– Thomas Schmeling, Managing Director of CryptoStruct

The Deribit team was one of the first to launch European-style cash-settled options on BTC and ETH, and have established functionalities including multi-instrument block trade, market maker protection, and portfolio margin for crypto derivatives.

“We are delighted to partner with CryptoStruct and enable our client base to trade on Deribit using their low latency trading solution. We look forward to supporting the further growth of their business through our joint offering.”

– Luuk Strijers, Deribit’s Chief Commercial Officer

The post Low latency crypto trading platform CryptoStruct adds gateway to Deribit derivatives appeared first on CryptoNinjas. [...]

November 11, 2021CryptoToday, the team of European-based crypto exchange BitBay, announced a rebranding to Zonda. Along with the re-brand comes a new website, logo, and overall visual design. Moreover, in early mid-2022, the Zonda team plans on launching its new trading platform and mobile application.

“Today is a big day for us – BitBay is now Zonda. We are changing our name and logo, and moving our website to the new domain of zondaglobal.com. Eight years of growth, and a rapidly expanding portfolio of products, have led us to the next step in our evolution. A new name, Zonda, which reflects the ‘winds of change’ currently taking place in the industry; a new strategy, focused on regulation, simplification, and education; and a new leadership team, with ambitions to grow the company’s global footprint.”

– The Zonda (formerly BitBay) Team

This re-brand vision was mostly influenced by the company’s new CEO Przemysław Kral, who earlier held the office of Chief Legal Officer at BitBay and has 20 years of experience in the legal field.

Przemysław helped Bitbay to obtain an Estonian FIU license and become the first exchange in Estonia to pass the full financial audit. Finally, a newly appointed board of directors now includes Przemysław Kral as CEO; Kamil Sikorski as Chief Growth Officer; and David Sendecki as CCO.

The post European based crypto exchange BitBay rebrands as Zonda appeared first on CryptoNinjas. [...]

November 11, 2021CryptoPolygon, an Ethereum scaling platform, today announced the addition of fiat payment onramps for its network, thanks to a new partnership with Alchemy Pay.

Alchemy Pay will create a bridge between fiat and crypto payments by embedding into the Polygon Network, enabling any Polygon-based protocol to set up a fiat on-ramp. Additionally, the move will simplify DeFi app payments on e-commerce platforms, such as Shopify and other networks.

More than 4,000 hosted apps within Polygon’s DeFi ecosystem will now be able to enact transactions on their DeFi apps via direct fiat on-ramps to traditional financial payment platforms like Visa, Mastercard, PayPal, and multiple local payment channels.

Currently, Alchemy Pay handles $5M in daily transactions, mostly from Asia and Europe. A higher volume of U.S. transactions is foreseen after Shopify completes integration with Polygon by the end of 2021.

“DeFi protocols have been flourishing but challenges with Ethereum’s usability at a global scale have slowed development. Scaling solutions are vital to DeFi’s ability to go mainstream. Polygon is already solving the problem of Ethereum’s slow and costly transactions, and now thanks to Alchemy Pay, we can provide an essential gateway between fiat and crypto transactions. This development opens up new capital inroads that will propel users of polygon’s DeFi ecosystem onto the next level in their commercial development.”

– Sandeep Nailwal, Co-Founder of Polygon

As a full-stack scaling platform, Polygon has become a leading solution in reducing congestion on Ethereum. In September, the number of daily active users on Polygon regularly surpassed those on Ethereum. Yet, rather than being a competitor to Ethereum, Polygon facilitates activity on Ethereum.

Still, DeFi advocates acknowledge that Ethereum needs to find ways to accept fiat into the ecosystem. The network’s ability to manage transactions between fiat and crypto will be crucial for drawing users.

“The integration of fiat payment options is key to the goal of a frictionless payment experience on crypto networks. It will reduce the tendency of users to hold tokens long term and make it more appealing to use them within dApps. This, in turn, will appeal to developers who want to build DApps that people can actually use. Both Polygon and Alchemy Pay enable people to use blockchain apps and DeFi platforms rather than just speculate on the tokens.”

– John Tan, CEO of Alchemy Pay

Moreover, Polygon and Alchemy Pay are also both part of a newly-forming Blockchain Infrastructure Alliance (BIA) of leading blockchain infrastructure builders. The BIA is made up of crypto exchanges, stablecoin issuers, DeFi platforms, payment solutions, and other vital roles to promote and drive the growth of the cryptocurrency and blockchain space. The BIA funds research and nurtures projects that seek to optimize DeFi and blockchain infrastructure.

The post Polygon integrates fiat payment gateway via Alchemy Pay appeared first on CryptoNinjas. [...]

November 11, 2021CryptoMeow, a platform offering a compliant bridge for institutional and corporate investors to participate in cryptocurrency investment opportunities, today announced that the company has raised USD $5 million in a seed round of funding. Coinbase Ventures, Gemini Frontier Fund, Lux Capital, and others including Jump Capital, Slow Ventures, Shine Capital, Castle Island Ventures, Acrylic, participated in the round.

Until now, corporate treasuries have lacked a compliant, user-friendly path to deliver cash-in-cash-out participation in crypto investment opportunities. Meow seeks to eliminate the need for complex crypto wallets and enable a direct and compliant bridge between institutional investors and crypto market yield. The company plans to provide direct access to decentralized finance (DeFi) protocols for crypto yield.

“Corporate treasuries, who are typically more cautious and measured investors, will have direct, cash-in-cash-out access to the most trusted digital trading desks and protocols, to potentially yield them return on cash that currently sits idle in a savings account,” said Brandon Arvanaghi, co-founder and CEO, Meow. “Meow ensures SEC-compliant access for corporate treasuries to emerging crypto opportunities, which is what they have been quietly asking for and now opens the doors for Wall Street to confidently participate.”

Aiming to deliver compliant investing for corporate treasures, the Meow platform will offer some protection from the risks of inflation and provide crypto-sourced yield in fiat (USD). Enabling corporate investors to interact with DeFi protocols in cash, which is an established way for them to operate, will provide a user-friendly, compliance-first, sustainable and long-term approach to participate in emerging crypto investments and potential yields.

The post Meow raises $5M in seed funding to build bridge between corporate treasuries and crypto yield market appeared first on CryptoNinjas. [...]

November 11, 2021CryptoMatter Labs, the company behind zkSync, an Ethereum layer-2 scaling protocol, announced today it received USD $50 million in new funding (in addition to a USD $6M Series A in February of this year). These new funds will be used to expand Matter Labs’ engineering teams and finance business growth.

zkSync uses advanced math to scale Ethereum in a fully trustless manner.

”It is a mission-driven project,” said Alex Gluchowski, Co-Founder and CEO of Matter Labs, “our long-term goal is to make self-sovereign participation in the digital economy — that is, maintaining true control over one’s digital assets — affordable for anyone in the world.”

The Series B financing was led by Andreessen Horowitz and included existing investors Placeholder, Dragonfly, and 1kx. Additionally, this second financing was closed with strategic partners such as Blockchain.com, Crypto.com, Consensys, ByBit, OKEx, Alchemy, Covalent and joined by the founders and leadership of AAVE, Paraswap, Lido, Futureswap, Gnosis, Rarible, Aragon, Liquity, Celer, Connext, Perpetual, Euler, Opium, and a host of others.

“Until recently, we have been focused nearly exclusively on technological innovation. Now it’s time to put a similarly concerted effort into reaching users and developers, which will require scaling our business development and marketing efforts and building out our community and ecosystem,” said Zoé Gadsden, COO of Matter Labs.

A pioneer of Zero-Knowledge Proof technology on Ethereum, Matter Labs launched the first-ever public ZK rollup prototype in early 2019

Fully inheriting Ethereum’s security guarantees, zkSync adopts the ZK rollup architecture — the only blockchain scaling approach that relies on pure cryptography instead of collectively trusted validators, bridges, or watchers. ZK stands for Zero-Knowledge (Proofs), a family of sophisticated protocols for attestation of computational integrity.

Further, zkSync v2 will support EVM-compatible, composable smart contracts. It is the first-ever ZK rollup with a ported Solidity dApp live on its testnet.

“zkSync will enable Ethereum transactions at a much higher rate and lower gas fees than mainnet. The math used by Matter Labs is really quite beautiful, and it is remarkable to see this coming to fruition at a massive scale so soon,” said Dan Boneh, Professor of Computer Science at Stanford.

The post Matter Labs receives $50M in new funding for its Ethereum scaling protocol – zkSync appeared first on CryptoNinjas. [...]

November 11, 2021CryptoTulip, a yield aggregation and leveraged yield farming protocol, announced today it is integrating Chainlink Price Feeds. By integrating the popular oracle network, Tulip will gain access to a high-quality, tamper-proof source of financial market data needed to secure leveraged yield farm positions. As a result, both lenders and borrowers will have greater assurance that risky positions will be properly liquidated.

“We chose Chainlink as our go-to oracle solution because of its no-compromise approach to security and reliability, demonstrated by its verifiable history of accuracy and resilience during extreme market volatility, exchange/API downtime, and data manipulation attacks such through flash loans. Additionally, Chainlink Price Feeds on Solana can publish oracle updates on-chain at sub-second frequencies and with full market coverage to further ensure price data is reflective of real-time, global market conditions.”

– The Tulip Team

Securing Liquidations With Chainlink Price Feeds

A yield aggregation platform powered by Solana, Tulip offers advanced auto-compounding vault strategies. By taking advantage of Solana’s low-cost, high-speed blockchain network, yield can be frequently reinvested into vault strategies.

Stakers then benefit from higher returns without requiring active management. Tulip also offers leveraged yield farming for users to increase their yield when depositing into two-sided liquidity pools.

The leveraged yield farming platform aims to connect lenders—who earn an auto-compounded variable deposit rate yield—with borrowers who wish to increase their yield farming profits by paying to borrow additional assets that then get deposited into a farm.

When a leveraged yield farm position is opened, a user supplies and borrows against their collateral, depositing both assets into a liquidity pool to earn liquidity mining incentives and trading fees.

Opening a position results in the creation of a collateralized loan that must maintain a predefined loan-to-value (LTV) ratio. If the value of the collateral drops below an unsafe level, then the collateral is liquidated and sold to pay back the lenders.

In order to settle when yield farming positions should be liquidated, Tulip requires price data to determine the value of both the collateral and borrowed assets, which are used to calculate the LTV ratio.

However, due to the blockchain oracle problem, smart contracts cannot natively access off-chain data such as aggregated market prices. Smart contracts require an additional piece of infrastructure known as an oracle to fetch external data and deliver it back on-chain.

Because liquidations play such a key role in managing the risk exposure of the platform, Tulip’s oracle solution needs to also aggregate from many oracle nodes and sources to ensure accuracy, uptime, and resistance to manipulation.

After looking into different oracle solutions, the Tulip team determined that Chainlink could provide the perfect blend of premium data quality, robust oracle security, and rapid update frequency to help ensure its liquidation mechanism follows markets in real-time.

Reasons for choosing Chainlink Price Feeds include:

High-Quality Data — data is sourced from numerous premium data aggregators, providing price data that is aggregated from hundreds of exchanges, weighted by volume, and refined from outliers and suspicious volumes.

Secure Node Operators — independent, security-reviewed, and Sybil-resistant oracle nodes run by leading blockchain DevOps teams, data providers, and traditional enterprises ensure reliability, even during high gas prices and extreme network congestion.

Decentralized Network — decentralized at the data source, oracle node, and oracle network levels, Chainlink offers strong protections against downtime and tampering by either the data provider or the oracle network.

Blockchain Agnostic – Chainlink’s oracle networks operate at the native speed of the chain where data is being delivered without cross-dependencies on any other blockchain network. Chainlink Price Feeds on Solana have no dependencies on other chains, allowing for high-frequency updates at lower costs.

The post Tulip integrates Chainlink on its Solana-based leveraged yield farming platform appeared first on CryptoNinjas. [...]

November 11, 2021CryptoXago, a crypto exchange services company based in South Africa, has announced the launch of their mobile application which includes neuromorphic biometric technology to authenticate clients.

The mobile app uses advanced (future generation) neuromorphic computing technologies to simulate human cognition – how the brain naturally and instinctively recognizes people. The result is a more secure and more convenient client experience when registering and logging in to Xago’s platform.

“Developed by research scientists at aiQ Cognitive Technologies, not only does the app’s authentication outperform conventional biometrics (fingerprint, facial recognition, voice recognition), but it also does what no on-device biometric is able to do – certify the identity of a person by referencing identity data held by the Department of Home Affairs (DHA), in real-time.”

– Mark Chirnside, CEO & Co-Founder of Xago

According to the Southern African Fraud Prevention Service (SAFPS), identity theft was up by 337% in 2020, indicating that the Covid-19 pandemic created a massive opportunity for fraudsters.

Taking security, client verification, and authentication seriously, Xago’s mobile app has now made conventional login names, passwords, and One-Time Passwords (OTPs) outdated and redundant.

Moreover, the Xago mobile app also offers not only 2 Factor Authentication (2FA) but 3 Factor Authentication (3FA). 3FA has all three of the following categories: knowledge (e.g. password), possession (e.g. mobile device), and inherence/biological feature (e.g. facial recognition).

Now, Xago’s clients can simply look at their phone without having to type, touch, swipe, scroll, press, or enter any information, knowing that they cannot be replaced by a fraudulent actor.

The post South African crypto exchange Xago adds neuromorphic biometric tech to authenticate clients appeared first on CryptoNinjas. [...]

November 11, 2021CryptoQuick take:

Bitcoin (BTC) has once again reclaimed $9,000 with 5 days until halving.

Pantera Capital’s CEO, Dan Morehead, sees a scenario where BTC hits $115,212 by August 2021.

His analysis is based on the change in the stock-to-flow ratio across each halving.

The hype and excitement surrounding the Bitcoin halving event is once again evident in the current price of BTC. At the time of writing this, Bitcoin has just broken both the $9,000 and $9,100 resistance levels and is trading at $9,261 with 5 days until halving. A brief analysis of the BTC/USDT 6-hour chart reveals that there is renewed buying interest as we draw closer to the estimated halving date of May 12th.

6-Hour BTC/USDT chart courtesy of Tradingview.com

Pantera Capital CEO Predicts Bitcoin (BTC) Could Hit $115k After Halving

With the Bitcoin halving only days away, Pantera Capital CEO, Dan Morehead, has predicted that BTC could hit $115,212 by August of 2021. His analysis is based on the change in the stock-to-flow ratio across each halving. Mr. Morehead made this predication via twitter and further elaborated on his analysis via an informative Medium blog post. His tweet can be found below.

#bitcoin could hit $115,212 in Aug 2021 based on the change in the stock-to-flow ratio across each halving.

More details here: https://t.co/fMYDXAT5qy pic.twitter.com/02uCpVoGKN

— Dan Morehead (@dan_pantera) May 5, 2020

Further highlighting key points from his Medium post, Mr. Morehead explained how a reduction in supply of BTC after each halving, will impact the price of Bitcoin.

One potential framework for analyzing the impact of halvings is to study the change in the stock-to-flow ratio across each halving. The first halving reduced the supply by 15% of the total outstanding bitcoins. That’s a huge impact on supply and it had a huge impact on price.

Each subsequent halving’s impact on price will likely taper off in importance as the ratio of reduction in supply from previous halvings to the next decreases.

Furthermore, his analysis went on to elaborate on the impact each halving has had on the price of Bitcoin.

The second having decreased supply only one-third as much as the first. Very interestingly, it had exactly one-third the price impact.

Extrapolating this relationship to 2020:

The reduction in supply is only 40% as great as in 2016. If this relationship holds, that would imply about 40% as much price impulse — bitcoin would peak at $115,212 /BTC.

Image courtesy of Pantera Capital on Medium.com

What is Stock-to-Flow Ratio?

The Stock-to-flow ratio is a measure traditionally used to gauge the abundance of commodities. It is calculated by dividing the amount of a commodity held in inventories, by the amount being produced annually.

In the case of Bitcoin, it is calculated by dividing the currently known supply of Bitcoin by the BTC mined annually. At the time of writing this, there is approximately 18.365 Bitcoin already mined with an annual production of 657,000 BTC per year. This results in a Stock-to-flow ratio of 27.9.

(Feature image courtesy of Unsplash.)

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of Ethereum World News or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you. [...]

November 11, 2021CryptoIn brief:

The price of US Crude oil fell hard to $0 with its futures contracts going as far down as $-40.

The once in a lifetime event, shook the crypto markets with Bitcoin (BTC) going back below $7,000.

At the time of writing this, the price of Ethereum (ETH) is holding the $168 support zone.

Analysts across the world have constantly been calling for a recession but no one was prepared for yesterday’s (April 20th) price action of US Crude Oil. The commodity fell hard to $0 per barrel with its futures contracts going down to negative territory. In the case of the latter, futures on US Crude Oil were at one point trading at $-40. However, and at the time of writing this, US Oil is currently trading at around $16.6 per barrel and $16.90 for its futures contracts. The aforementioned chaos did its fair share of damage to the price of Ethereum (ETH) as shall be elaborated.

Ethereum’s $168 Support Zone Holding Well

In one of our previous analysis of ETH/USDT, we had noted that the price of Ethereum was back in bullish territory. We had cited two reasons as to why this was so: Bitcoin’s dwindling dominance in the crypto markets and the prospects of ETH 2.0 launching later on this year. We had also identified $168 as a very strong support zone for the King of Smart contracts.

Revisiting our favorite ETH/USDT chart, we observe the following. In terms of lower time frame support zones, Ethereum has the following:

$168

$164

$162

$154

$150

$148

Ethereum’s current price at $170 is above the 50, 100 and 200 Moving averages thus providing one reason to still be optimistic that $200 is achievable.

However, the MACD has crossed in a bearish manner and the MFI also indicates that ETH/USDT is on course to retest some of the support zones identified above. Additionally, trade volume seems to be reducing in tandem with the rest of the cryptocurrencies in the markets including Bitcoin.

ETH 2.0 Progress

The Ethereum 2.0 testnet was successfully launched on the 18th of this month and has almost 20,000 validators in the few days that it has been active. The Mainnet launch is still on course to happen in July of this year.

Conclusion

On 20th April, we witnessed a history meltdown of the American crude oil prices as suppliers ran out of space of storing the commodity due to decreased demand. This is as a result of the global impact of COVID19. This meltdown affected both Bitcoin (BTC), Ethereum (ETH) and the majority of the cryptocurrencies in the markets. In the case of ETH, the coin is still holding the $168 support zone despite the oil crash. With the ETH 2.0 launch only days away, the coin might just live up to expectations of reclaiming $200. However, as with all Technical analysis, investors and traders are advised to use adequate stop losses to protect their trading capital.

(Feature image courtesy of Victor Freitas on Unsplash.com.)

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of Ethereum World News or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you. [...]

November 11, 2021CryptoIn brief:

Everyone was shocked when US Oil prices hit zero and global futures contracts fell hard into negative territory.

Such an event had not been anticipated by the team at the EMX exchange.

The team halted trading of its USOIL-Perp contract.

Trading of the perpetual contract is yet to be reopened as the team decides on a way forward.

Yesterday’s price movement of US Crude Oil shocked everyone. The majority of traders were confident that the price of the precious commodity would not break the various support zones that were last seen in the 1980s. However, the WTI Crude Oil chart went right through the decades’ strong support zones at $15, $12 and $9. The price per barrel went to zero as futures contracts went into negative territory as low as $-40.

EMX Exchange Halts Trading of its USOIL-Perp

Such a scenario of negative prices of US Oil futures contracts had not been anticipated by the team at the EMX Exchange. As a result, the team decided to halt the trading of its USOIL-Perpetual contract. The screenshot below shows that trading was stopped at 18:00 (UTC) on the 20th of April. The last price of the USOIL-Perp contract was $3.48. This is after its value almost hit zero.

USOIL-Perp Chart courtesy of EMX.com

Unexpected Sequence of Events

As earlier mentioned, very few traders and investors had anticipated that the price of US Crude Oil futures contracts would go into negative territory. The team at EMX has also explained that such a scenario had not been planned for. They have since issued the following statement via Twitter explaining the situation at hand.

We are currently investigating ways to move forward with USOIL-PERP due to negative underlying prices, an edge case that we had not built for.

Additionally, the team has halted withdrawals as they verify all transactions. They explained this in a follow up of the first announcement.

For those of people who concerned about withdrawal, we are manually verifying all transactions and everyone should get it back within 1-3 business days. We apologize for the inconvenience.

For those of people who concerned about withdrawal, we are manually verifying all transactions and everyone should get it back within 1-3 business days. We apologize for the inconvenience

— EMX (@TradeEMX) April 21, 2020

What’s Next for USOIL-Perp Traders on EMX?

As the stoppage only affects the USOIL perpetual contract, trading of other contracts on EMX is still much active. However, traders who anticipated the Crude Oil meltdown and decided to go SHORT, might have to wait till the team at the exchange decides on a way forward.

More About EMX Exchange

Founded in 2017, the Evermarkets Exchange (EMX) has a vision of revolutionizing the global derivatives markets. The exchange does this by allowing users to trade contracts on equities, currencies, commodities as well as popular cryptocurrencies. The latter includes perpetual contracts on Bitcoin (BTC), Ethereum (ETH), EMX token, ChainLink (LINK) and Tezos (XTZ).

(Feature image courtesy of Erwan Hesry on Unsplash.com.)

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of Ethereum World News or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you. [...]

November 11, 2021CryptoIn brief:

Robinhood has secured $280 Million Series F funding after an $8.3 Billion valuation.

The funding will drive a push to expand the platform globally.

Robinhood also plans on scaling the platform and offering more products to users.

The team at the popular trading platform of Robinhood has announced that the firm has secured $280 Million series F funding after an $8.3 Billion valuation. The round of funding was lead by Sequoia Capital which is an existing investor of Robinhood. Other existing and new investors that participated in the Series F funding include NEA, Ribbit Capital, 9Yards Capital and Unusual Ventures.

New Funding to Push for Global Expansion

The team went on to elaborate that the funding will be used to scale the platform, build and develop new products and accelerate their expansion. In a recent interview with Fortune, the co-CEO of Robinhood, Vlad Tenev, further elaborated on this goal as follows:

The purpose of the capital raise is to enable us to have flexibility and be strategic, and continue to invest in the platform.

We envision that over the next few years, Robinhood will expand globally and continue rolling out more products.

Stability Concerns Still Linger

Amidst the current stock and crypto market volatility, Robinhood has managed to add more than 3 Million funded accounts so far this year. According to Robinhood, half of their new customers are first-time investors.

However, the stability of the platform has been questioned by not only Millenials who prefer using the platform, but by investors who are waiting for Robinhood to go public through an IPO. During the Coronavirus crash of 2020, the platform suffered an outage on 2nd March. The day proved to be one of the most volatile due to the economic effects of COVID19. Trading functions were fully restored on the 9th of March which is a full week after the event.

Trading has been restored and Robinhood is back up and running again. Thank you for your patience as we resolved this issue.

— Robinhood Help (@AskRobinhood) March 9, 2020

List of Cryptocurrencies Available for Trading on Robinhood

At the time of writing this, Robinhood currently supports trading of the following cryptocurrencies.

Bitcoin (BTC)

Ethereum (ETH)

Litecoin (LTC)

Bitcoin Cash (BCH)

Dogecoin (DOGE)

Ethereum Classic (ETC)

Bitcoin SV (BSV)

(Feature image courtesy of Unsplash.com.)

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of Ethereum World News or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you. [...]

November 11, 2021CryptoIn brief:

In a recent tweet, the team at BitTorrent (BTT) has highlighted why the BTFS file system is better than Filecoin (FIL).

The teams behind both projects have been throwing jabs at each other ranging from accusations of plagiarism and going as far as claiming the other is ‘vaporware’.

Filecoin’s (FIL) Mainnet is set to be launched between mid-July and mid-August.

In a recent tweet, the team at BitTorrent (BTT) highlighted why its BTFS file system is better than Filecoin (FIL). The tweet showcased how the BTFS system has more to show than Filecoin that is yet to launch its mainnet after several postponements. The lack of Filecoin having a functional product is the focal point of the debate as to which is better. The full tweet by BitTorrent made 8 comparisons that can be found below.

Why #BTFS is better than #Filecoin?1⃣ Integrated with $BTT economy2⃣ #TRON network3⃣ 100M user base4⃣ Simple and intuitive Host UI5⃣ Mainnet launched6⃣ #BitTorrentSpeed、#DLive7⃣ Active community8⃣ Dedicated global professional teams#BTT @justinsuntron @OfficialDLive pic.twitter.com/eY3KSQVE5H

— BitTorrent Inc. (@BitTorrent) May 4, 2020

Previous Tweef Between Filecoin (FIL) and BitTorrent (BTT)

The recent tweet by BitTorrent is a follow up of a Tweef that transpired in mid-April between Justin Sun and Juan Benet of Filecoin (FIL). Benet was the first to point out that BTFS’ new logo looked like it had been plagiarized. His remarks alluded to the fact that Justin Sun and the Tron Foundation have been accused of borrowing ideas from other open-source projects.

Aaaaaahahaha it’s not enough to fork all our code, rebrand it and lie its theirs; copy paste random chunks of our papers, and defraud their investors with a nonsensical mishmash. Tron also can’t even think of an original logo.

Justin Sun was quick to respond to the accusations by asking if the hexagon shape on the new BTFS logo was owned by Benet. Sun went on to accuse Filecoin of copying BitTorrent’s technology. Additionally, he slammed the project as being ‘vaporware’ with no functional product.

Filecoin’s (FIL) Mainnet Launch in 2020

Both the Filecoin and Tron ICOs were carried out in September of 2017. However, Tron has a wide range of achievements under its belt more than Filecoin. As earlier mentioned, the key to the whole discussion is that Tron launched its mainnet in mid-2018 and Filecoin has yet to launch its final version of the platform. At the time of writing this, Filecoin has set its mainnet launch for mid-July to mid-August this year.

(Feature image courtesy of Hermes Rivera on Unsplash.)

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of Ethereum World News or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you. [...]